So-called “casual gamers” are growing in numbers. However they may need a new name. Because their interest in these types of challenges is anything but casual.

According to Statista, 31% of adults — both men and women — spend an average of 15 minutes per day playing such games. What’s more, most of these experiences are mobile phone based, suggesting users repeatedly open these apps or websites throughout the day.

This is now driving more and more publishers, social media sites and marketing operations to expand their use of gaming as a way to draw readers and prospects in, increase page duration numbers, amplify advertising value and generate sales.

While the trend is relatively new for most of these would-be game platforms — and therefore difficult to evaluate yet — the grande dame of this trend, The New York Times, yields a wealth of useful data.

Which is why the team at Datos decided to look at the space, to see whether the trend is indeed driving increases along the core metrics of success and determine if this is an opportunity others should be considering.

The Promise of the Times Experiment

Out of all the companies experimenting with adding games to drive page views and increase duration of site visits, The New York Times has clearly led the pack.

Starting with the famed NYT crossword, the organization has been steadily expanding its library of daily gaming experiences over the past few years. Developing or purchasing various titles such as Spelling Bee, Wordle, Connections and more, the company is now showing notable growth in the key success metrics.

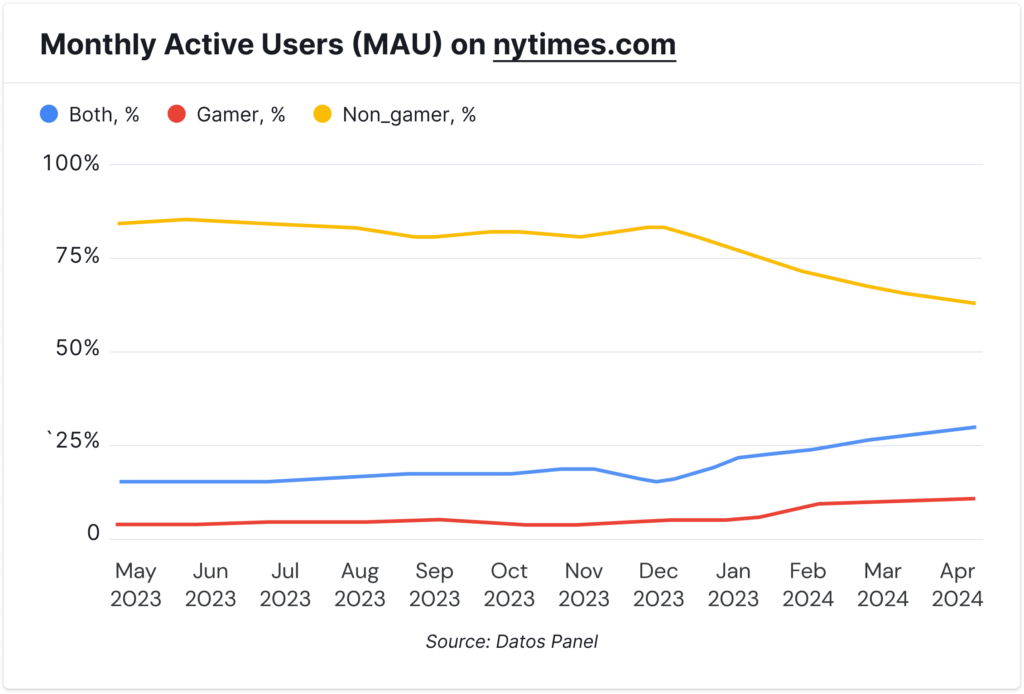

As you can see from the chart below, the rate of users showing up only for games via the web page has increased from a low last year of 2.3% to 9.6% in April of 2024 — a jump of over 7%. And when we look at the users who show up for both the games and the news available on the platform, the jump is 15.3%, up to 28.9% of the audience. All in all, gamers now make up 38% of the NYT audience.

“Gamers” are NYT site visitors who only consume gaming content. “Non-Gamers” are NYT site visitors who only consume news content. “Both” designates NYT gaming visitors who also consume news content.

The good news doesn’t end there, though. Retention is extremely good for these game enthusiasts. During the first month of play, 35.6% of these gamers will return to the site. There is a drop off during the second and third month, but this seems to stabilize at 15.2%, which is still an incredibly strong number.

Average number of news sessions for each gamer is also higher than the news-only audience. Gamers will consume news content an average of 8.7 times a month, while the news-only audience only visits the site 3 times a month.

Further, the average time gamers spent on all site content is nearly double that of those only consuming news — 11.2 minutes versus 6 minutes.

But There are Concerns

While the above numbers are exciting, the news isn’t all good for the Times. Even though the net-total audience for games has shown good growth, the net-new audience is less responsive at this point, hinting at a significant growth hurdle going forward.

One month prior to their first visit to the games page, 15.3% of these net-new users viewed NYT news content at least once. This rises to 22.4% in the month immediately after, but then falls back to 16% in the second month.

Average number of clicks on news items follows a similar trajectory. In the month prior to their first gaming session, users are clicking an average of 2.1 times, which rises to 2.6 times in the subsequent month. But in the month after this, clicks actually decrease to an average of 1.9 times.

We also find the same story in the number of sessions, where new gaming users experience a small bump to an average of 2.2 sessions per month, only to fall back to 1.7 sessions — statistically the same level as before.

Parsing the Data into Action

Ultimately we have to look at the trend as a success and as something other companies should cautiously consider pursuing.

No matter how you parse the data, the NYT is showing both audience growth and positive audience adoption of core news content as a result of game content consumption. There is also a positive retention of net-new users for the entire NYT platform.

The problem, though, is none of this growth is particularly remarkable.

While .1% lasting and meaningful growth is indeed going in the right direction, it’s hardly a huge vote of confidence for the tactic. And we have to consider the lasting appeal of any specific game. After all, the Times has spent millions acquiring already popular games, yet has achieved only marginal success. One must accept that the odds are against anyone deploying smaller resources achieving any better results.

This is why we recommend pursuing a gaming strategy only if there is considerable commitment toward resources and time. Every successful game needs to find and connect with its audience and this rarely happens overnight. So setting appropriate internal expectations is essential.

We also recommend that anyone pursuing a game strategy to increase engagement with other portions of a site should be more intentional about these efforts than the NYT currently is. Adding in additional play opportunities or prizes/badges for investigating other content you offer could be the missing motivators toward achieving better results.

The data displayed in this article has been provided by Datos. As a leading clickstream provider, Datos has access to the desktop & mobile browsing behavior for tens of millions of users across the globe. The data used for this article comes from Datos’ US panel, representing a diverse and statistically significant sample of users during the dates of May 2023 — April 2024. For further information on how Datos collects and processes this data please review our Privacy Policy.