What Our Digital Behavior This Holiday Season Tells Us About Today’s Pragmatic, Value-Oriented Consumer

With the 2023 holiday season in the rear-view mirror, it is a good time to reflect on what holiday shopping patterns tell us about today’s consumer mindset and likely trends in the year ahead.

To do this, I synthesized data from a variety of sources. First among these was data from Datos, a global clickstream data provider focused on licensing anonymized, at scale, privacy compliant datasets.

Modest Consumer Enthusiasm for Holiday Shopping

As a whole, spending in the 2023 holiday season rose 3.8% from 2022, according to a National Retail Federation analysis of Census data. This increase from 2022 wasn’t particular to the holiday season, as retail sales for the entire year of 2023 rose by the same amount.

Important but often-overlooked context: inflation ended the year 2023 at 3.4% (admittedly a welcome relief from the 6-7% of 2021 and 2022). So most of that increased spending reflected rising prices, rather than rising consumer demand.

For a different glimpse in the consumer mindset, I examined Datos data about daily traffic during the holiday season for 10 key e-commerce websites. (I defined the “holiday season” as November and December, but also did deep dives into the data for the days leading up to Black Friday and Christmas.) It is important to note that this analysis doesn’t include app usage on mobile devices, but even without it, these year-over-year changes in web traffic are instructive. In 2023, holiday traffic to these sites dropped 7%, after rising 10% the year before. Holiday season traffic to Amazon dropped 8%, after rising 19% a year ago. If we remove Amazon from the analysis (an obvious outlier in terms of sales volume), we find that the remaining nine sites dropped 4% in 2023, compounding a 6% drop the previous year.

The big winner? Apple, whose holiday traffic rose 45%, was buoyed by new versions of the iPhone, Apple Watch and Airpods. Among those losing traffic were Best Buy (-29%), Target (-17%) and Walmart (-12%). The data also show a changing of the guard at the lower end of the e-commerce spectrum. Traffic to Wish dropped 61%, while traffic to Temu rose 275%. Both have similar business models, specializing low-cost, questionable-quality, slowly-delivered, mostly-Chinese products.

Keep in mind that these figures are traffic (website visits), not sales. Lower traffic doesn’t necessarily mean lower sales. Perhaps people bought more stuff per visit (“bigger baskets”). Or people might have done less “window shopping,” instead going to sites with a stronger intent to purchase specific items (“increased conversion rates”). Either way, the results imply that this year’s holiday shoppers displayed less enthusiasm for the shopping process, and a desire to minimize the time, effort and emotional engagement with that process.

This year, holiday shoppers displayed less enthusiasm for the shopping process, and a desire to minimize the time, effort and emotional engagement with that process.

Top Search Terms Also Reflect a Subdued, Practical Mindset

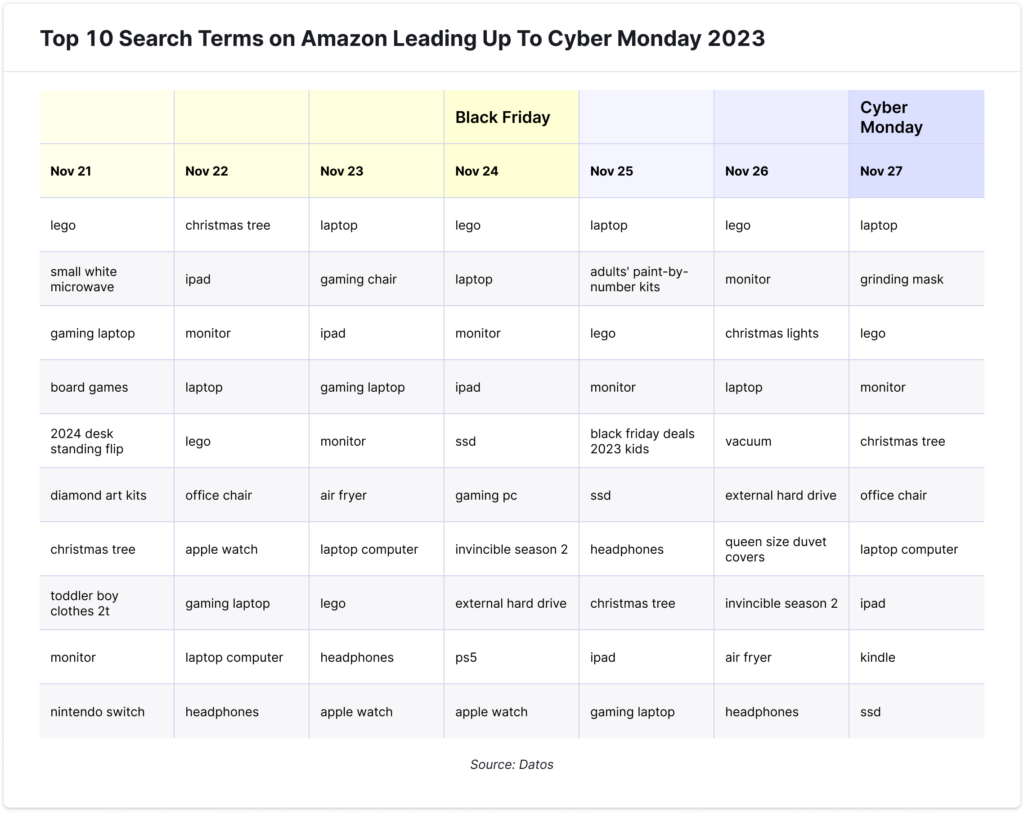

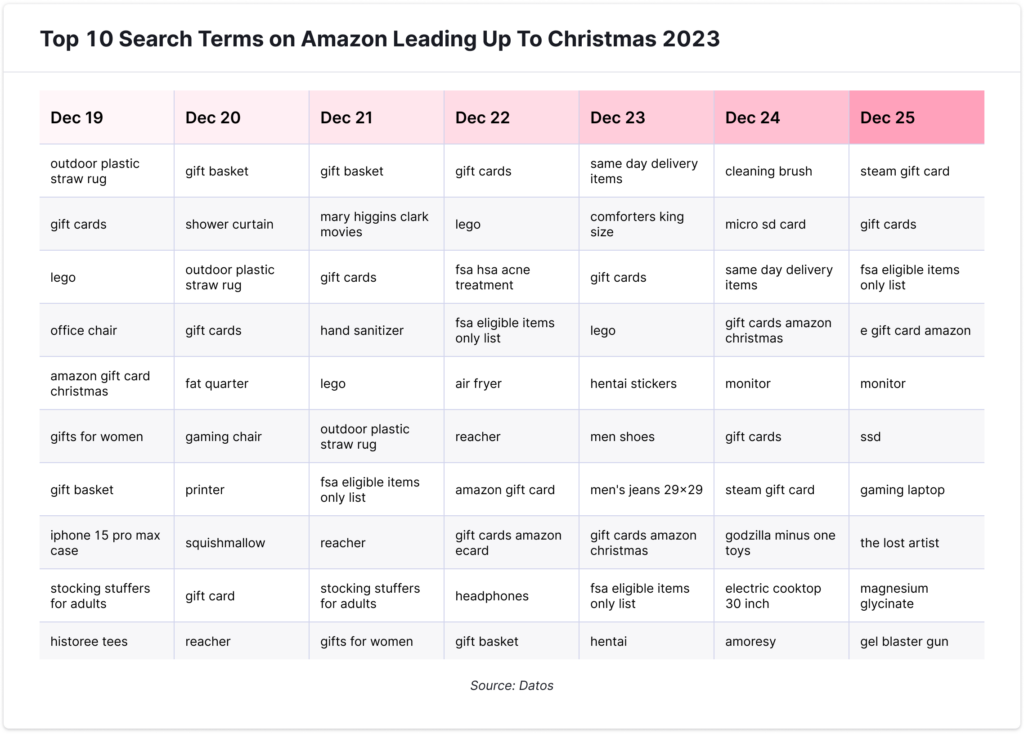

For another lens into consumer mindsets and holiday shopping, I looked at daily data from Datos about top search terms on Amazon. The take-away reinforces what we saw in the traffic data: holiday shoppers were practical, pragmatic, and value-oriented.

Of course, pragmatic, utilitarian, unbranded purchases have always been Amazon’s wheelhouse. And this is particularly evident looking at the top Amazon search terms from early November, before the holiday rush set it. Top search terms varied from day to day, but key themes emerged:

- Clothing (particularly children’s clothing and men’s winter boots)

- Generic physical hardware such as tools and screws, as well as generic electronic hardware such as SSDcards and charging cables and phone cases.

- Home goods such as pillow cases, comforters, and outdoor rugs

- Trending Amazon Prime video content

- Holiday prep items such as Christmas trees and Christmas cards

About a week before Black Friday (in 2023, Black Friday was on November 24), the tone shifts. Black Friday sales rose to the top of the list for three consecutive days (November 18, 19 and 20). And rising up the list on those days are the terms that led consistently the list heading into Black Friday itself – lego and laptop. And as Black Friday approached, searches for bigger ticket items increased, including generic appliances (microwave, air fryer) and larger tech accessories (monitor, headphones, hard drive). Among the few branded terms to join the list are various Apple products, Nintendo Switch, and PS5. These same kinds of searches remained popular through Cyber Monday.

The week leading up to Christmas reveals a similar pattern of practicality. Searches related to gift cards rise to the top (particularly on Christmas day itself). Same-day delivery items surged in the two days before Christmas. Perhaps most telling – a large number of searches related to items eligible to be bought with Flexible Spending Accounts (FSAs) or (Health Savings Accounts (HSAs). Forget holiday indulgences – it doesn’t get much more practical than using remaining HSA/FSA funds for medical-related expenses before the year ends.

Noticeable by their general absence from these lists: Squishmallows. The plush stuffed toys consistently ranked among the top ten keywords last year, and peaked at #2.

This year, they only made one of these top 10 lists, ranking #8 on December 20 (and their number of Instagram followers dropped slightly). This year’s holiday shoppers were less interested in “warm fuzzies” – literally and emotionally – and more focused on the practicalities. Instead, the indulgences evident in 2023 were low-cost and experiential in nature – such as board games and adults’ paint-by-number kits.

Another notable difference from 2022 – the relative absence of searches for video game consoles. Last year, Nintendo, PS5 and Xbox were among the more common branded search terms. Without new versions to generate interest, and without splurge-oriented consumers, gaming platforms didn’t rise to the tops of consumer holiday wish lists.

In the final analysis, while macro-economic indicators – such as GDP, unemployment rates, and the stock market – suggest a historically strong economy, the consumer mindset is quite different. Consumers are hedging, and seeking practical, value-oriented products and services.