Crypto doesn’t make the kinds of headlines that it used to. Today’s financial headlines emphasize inflation and recessionary fears, making crypto somehow seem like “old news” – that is, when the headlines don’t focus on crypto scandals. But the data tell a different story, revealing a still-volatile and dynamic marketplace.

I dug into historical data about crypto prices, as well as traffic and search data from Datos and Semrush to get more up-to-date insights about the state of crypto. (In the article below, data are from the U.S., unless otherwise noted).

Full disclosure – I started this project with the goal of predicting crypto prices followed by a plan of buying a yacht and retiring to a private island – that remains a work in progress 🙂

The Context: The Crypto Roller Coaster

Although crypto has been around since at least 2009, it burst into the national consciousness with a 2017 spike, followed by a 2021 headline-grabbing roller-coaster. Bitcoin broke through the $60K point in early 2021, quickly “crashing” by nearly half by summer, and rebounding to push through $64K by November. The pandemic wasn’t going away, and combined with geopolitical turmoil, it created a “perfect storm” of interest in a new, decentralized, tech-based financial solution. After all, this must be the future… right?

A bitcoin now (July 2023) hovers around $30,000 – down nearly half from its 2021 highs, but nearly double its lows of late 2022. Ethereum has followed basically the same pattern, although with more volatility (in relative terms, higher highs and lower lows). In contrast, the Dow is up a solid-but-steady ~10% since late 2022.

Searching for Answers: What Search Data Tells Us About Interest in Crypto

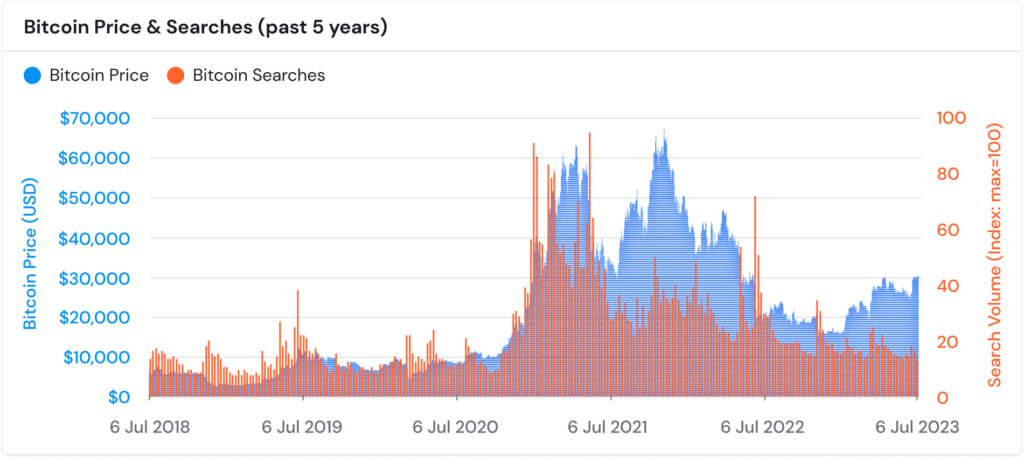

I also explored search data from Semrush and Google for terms like “bitcoin” and “crypto”, which is overlaid on a chart of bitcoin prices from the past five years below. Bitcoin prices are displayed in dollars, as reflected in the left vertical axis (in blue); searches for the term “bitcoin” are indexed to 100, reflecting the maximum number of searches over this time period, and are reflected in the right vertical axis (in red).

Searches and prices are very highly correlated (r=.70). Note that this chart reflects data from the past five years, and does not include the first “bitcoin surge” of 2017, when it spiked from roughly $1K to $20K, with a corresponding surge in search activity. Inclusion of this data would make the overall correlation even higher, but it is difficult to precisely measure search traffic trends more than five years in the past.

Examining “lagged” correlations (do crypto searches this week predict crypto prices next week?) did not add to the predictability of crypto prices (sadly, my yacht and island will have to wait). A surge in bitcoin searches in early 2021 did precede price surges later in the year, although this single instance remains anecdotal at best. A June 2022 surge in searches preceded a drop in prices that was already well underway, and coincides with the SEC lawsuit against Coinbase – still, cause-and-effect relationships remain far from clear. The data throughout 2023 reflects growing prices amid modest search activity, reflecting the “under-the-radar” nature of recent price growth.

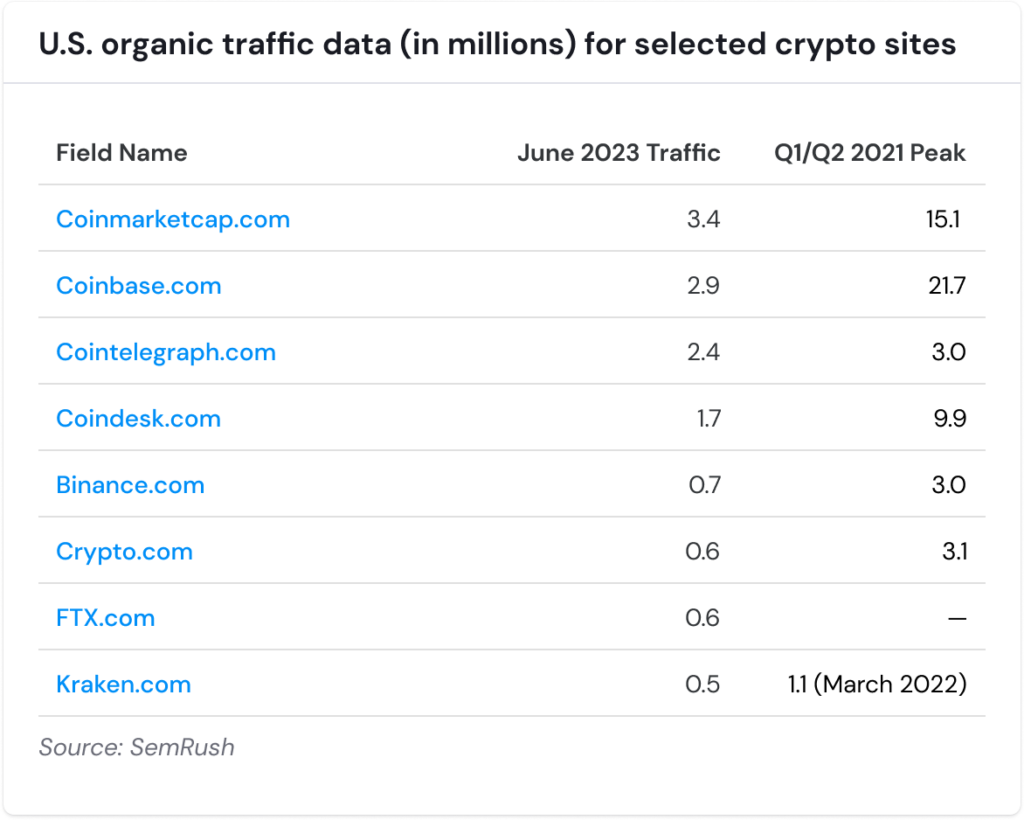

Like any market, there are many niches within the crypto ecosystem, and many players vying to occupy a role in that ecosystem – ranging from exchanges where people actually buy and sell, to sites more focused on news, information and analytics. All are down significantly from their peaks, but many nevertheless generate significant traffic. A handful at the top are shown in Table 1 below.

- Coinmarketcap is an informational site with extensive data and resources, generating over three million visits in the past month (that just in the U.S. – they also get significant global traffic, particularly in Turkey and India).

- Coinbase leads exchange sites by far, but is currently being sued by the SEC.

- Binance also faces a series of legal troubles.

- FTX.com traffic is near its all time high, but challenges the old adage “there’s no such thing as bad publicity”.

- Kraken.com stands out as a relative newcomer, and was generating positive buzz – having peaked in 2022, and “only” having dropped by 50% since then. “Kraken” had also grown strongly as a search term over that time, but various legal controversies regarding the company and their founder persist.

- Also generating significant traffic, but not shown below, are “crypto-info hubs” created by more traditional media outlets such as CNBC and Bloomberg.

Tech bros like crypto…. and advertisers like tech bros

Another remarkable aspect of the crypto craze is its ability to reach a market segment that advertisers struggle to get in front of: young men. Stereotypes aside, men outnumber women by roughly 2:1 across the main crypto sites, according to data from Datos. Men aged 35-44 typically make up 40-50% the total audience for these sites, and men 25-34 make up an additional 20-25%. Sports leagues generate huge advertising revenue in part because they reach live audiences, and attract young men who are notoriously difficult to reach through other advertising channels. Between their high discretionary income and their elusive nature, advertisers love tech bros, and crypto sites are attractive fishing holes for finding them.