Large investment houses may have a blind spot for the potential disruption posed by new tech

Robo-advisory has come a long way.

Initially developed to take some of the legwork out of researching and timing institutional investing decisions, these AI-fueled investing tools now equip individual investors, as well. They enable even the casual investor to investigate investment choices in seconds and predict market movements with a high degree of accuracy. And through the recent exponential advances in artificial intelligence and their near prescient performance, they have exploded in popularity in the U.S., and are now starting to pique interest globally.

A snapshot of the main players

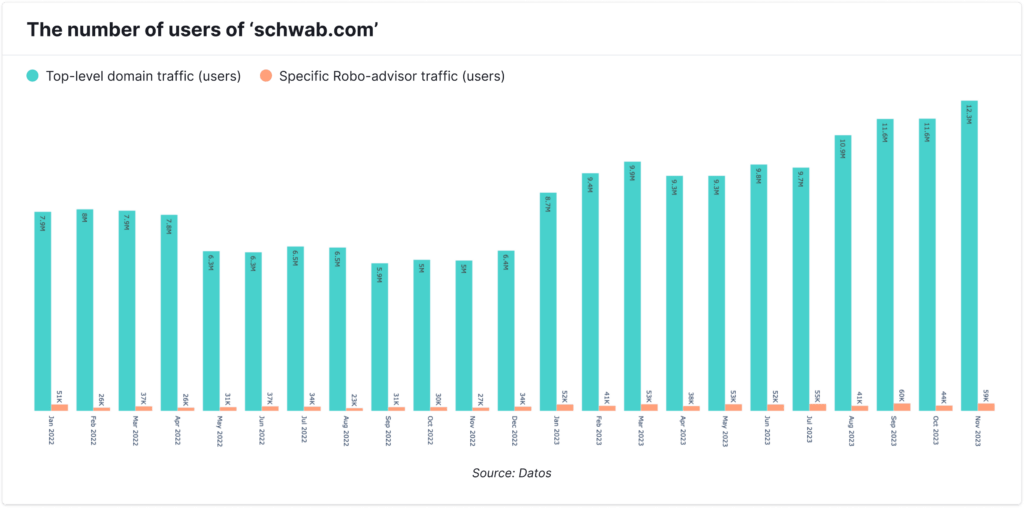

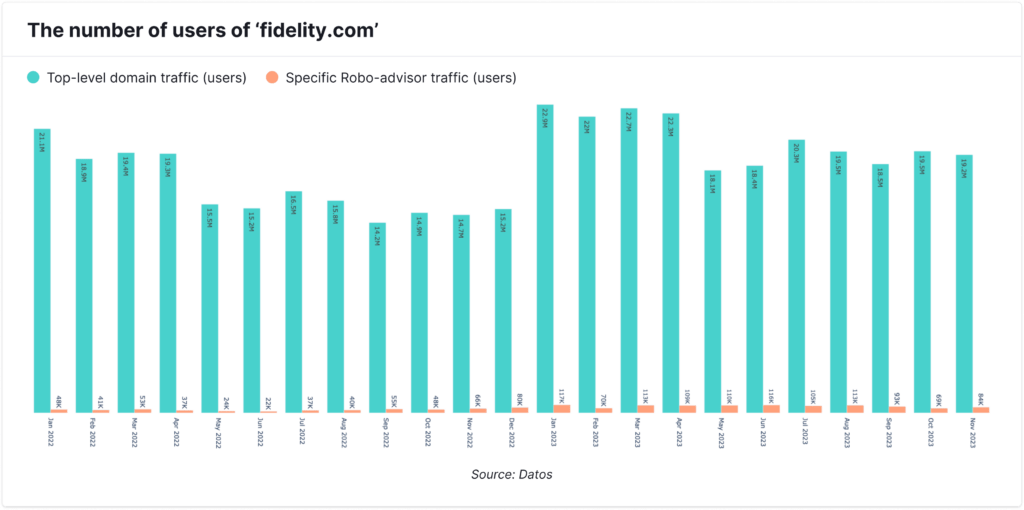

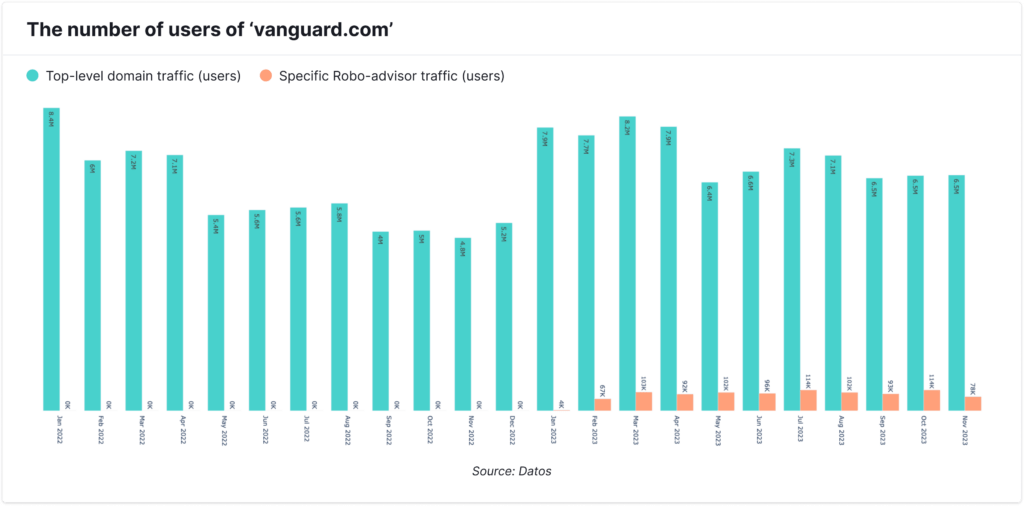

Using our clickstream data, which shows us the pathways that users access the content of a given site over time, we can see a definite growth trend for robo-advisors across the board. The traffic we found from January 2022 through November 2023 shows that all of the major competitors in the space have a significant amount of clicks focused on their respective robo-advisor discovery and education pages.

We also found that some of the biggest names in investing have entered the space aggressively. As you can see from the charts below, companies like Vanguard, Schwab and Fidelity are each now driving a sizable portion of their web traffic to their robo-advisory pages.

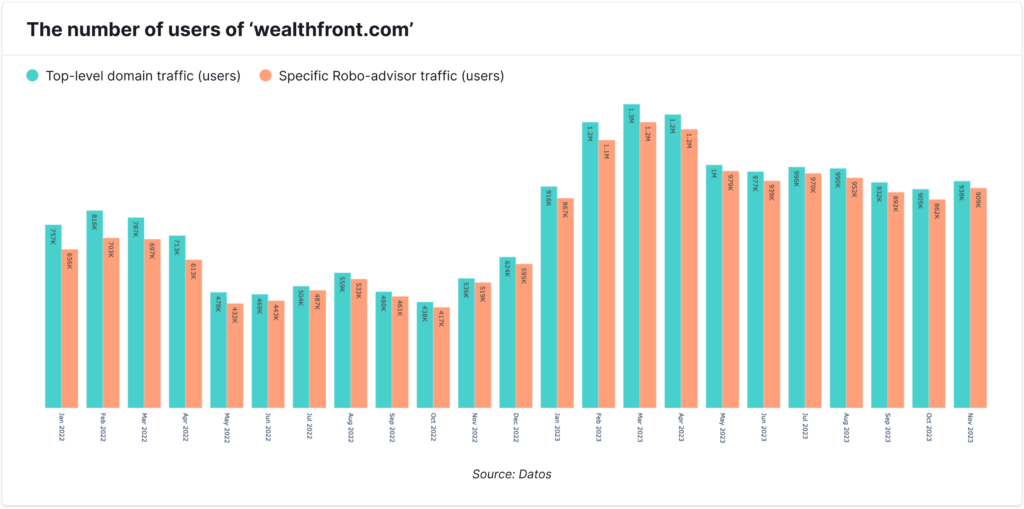

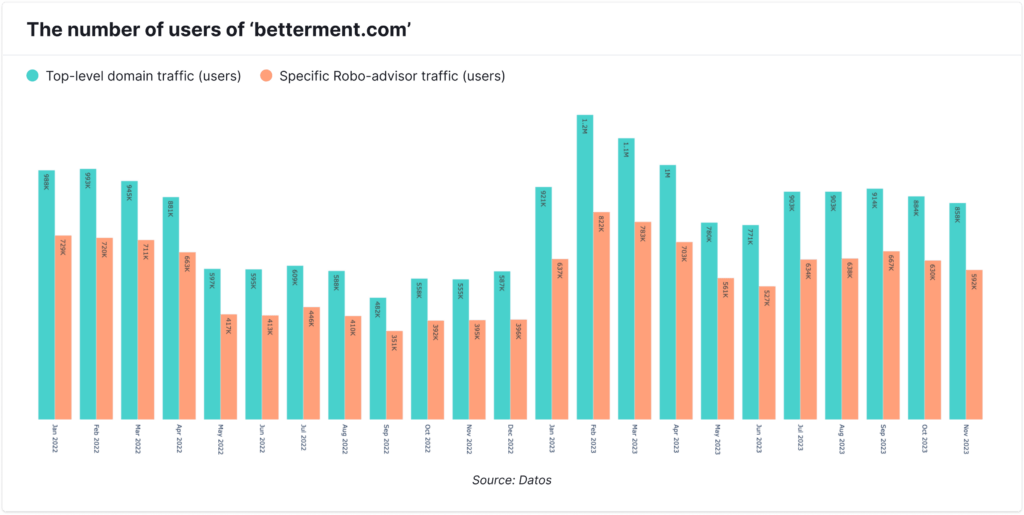

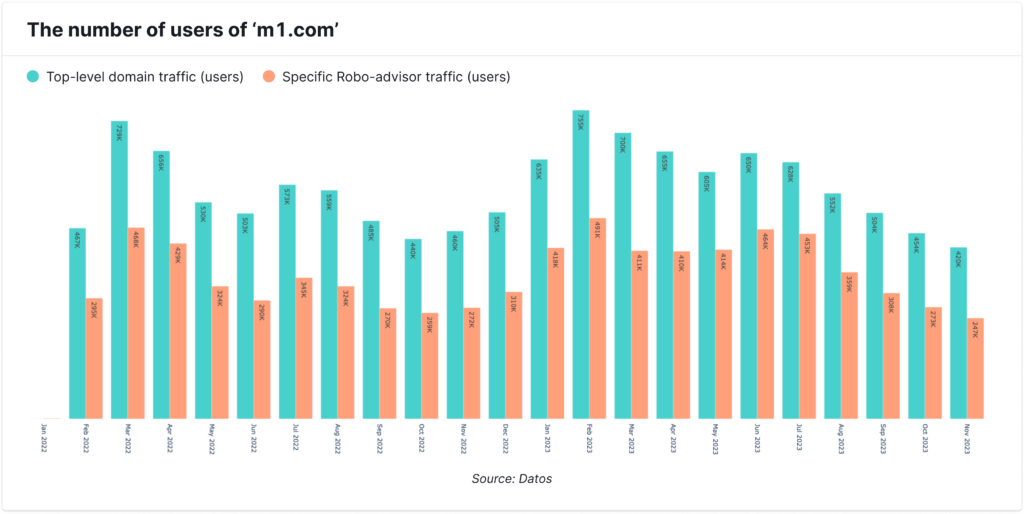

And yet, while the larger players in the space clearly dominate awareness and general click traffic to their top-level domains, the fact that challenger brands like Wealthfront, Betterment and M1 are exceeding this performance with far less overall traffic, could be a cause for concern.

Looking at the chart below, we find that Wealthfront alone commands nearly five times the traffic to its robo-advisory pages. Plus, all three of these fintech companies are driving a much greater percentage of their top-level web traffic to their respective robo-advisory content and tools.

Fintech’s traffic may signal stronger intent

Another thing to consider is the strength of consumer intent-to-join for each of these competitors

For instance, Vanguard is widely considered the top player in robo-advisory with the largest portion of assets under management (AUM). But of the top players, they drive the smallest number of clicks to their robo-advisory pages.

We can reasonably infer from this low click-through rate that the prospect pipeline for their technology is weak. We also can also assume that they are either not adequately promoting their services and/or have ineffective paths to conversion.

In contrast, we can look at Wealthfront and find strong indications of interest and intent-to-join. The percentage of the overall traffic reaching their robo-advisory pitch seems much more meaningful and interested in learning more. We can also assume they are more aggressively driving traffic to their robo-advisory tools and have established stronger pathways for conversion.

Why the investment giants need to pay attention

Now admittedly, as of 2022 only 1% of all investors had used a robo-advisor. We also know that as of 2023, only 20% of affluent millennials and a mere 13% of affluent Gen Xers had used a robo-advisor. So a certain amount of restraint from the big investment companies is understandable.

However, with a projected growth of 13.46% by 2027, representing over $2 trillion in assets under management by that time, it would seem now is the time to widen the competitive gaps.

Looking at the way the clickstream data matches up to outside studies, it’s clear that the big institutions are betting on hybrid solutions that depend on some connection to the master brand and its full line of services. After all, the hybrid robo-advisory market has accounted for 64% of the total market since 2021 and it seems to be working well for them in the short term.

The fintech players, though, now account for 45% of the total robo-advisory market, according to a 2022 Grandview study. This fact along with the clickstream data that shows nearly all of their traffic winding up on the robo-advisory pages, and it’s easy to conclude the fintech players should be considered more formidable competitors than they seem to currently be viewed.

What these findings should mean to you

Whether you’re an established brand or a competitor brand, the first thing this research tells us is that as AI improves and robo-advisors gain greater accuracy, intelligent investing will dominate this sector sooner than might be expected. It’s important to act on this insight as soon as possible.

Next, you should be aggressive about driving interest to your robo-advisory solution. For this, PR is the secret weapon of this sector.

A large majority of interested investors are eschewing ads, instead choosing news, research reports and other forms of editorial content to aid them in discovery. Dominating news cycles and establishing a stream of thought leadership pieces is essential for driving traffic to your robo-advisory content and converting prospects into clients.

You should also be optimizing your web presence with overt pathways to your robo-advisory content and tools. With potential clients largely finding their own ways to your site, you need to keep robo-advisory prominently displayed at every entry point.

And finally, be aggressive in both your tech development and your messaging. You need to build toward the market’s potential, rather than simply address the current state of the technology. As we’ve seen with all things AI, advancement is surging at an exponential pace. Waiting for the market to reach critical mass will simply allow more nimble competitors to fill the vacuum of your inaction.