After two years of chaos and uncertainty, the travel industry has finally reached pre-pandemic norms. In this article, we use search volume data to paint a picture of how people are satisfying their wanderlust in a post-Covid world.

In the spring of 2020, Arne Sorenson, then CEO of Marriott issued a dire statement to the public in an interview with CNN. “The travel industry is facing its most significant challenge in modern history. COVID-19 is having a more severe and sudden financial impact on our business than 9/11 and the 2009 financial crisis combined.”

Time would quickly prove him right. Experts suggest that Covid set the hotel industry back ten years in total. That’s not even taking into account the impact it had on car rentals, flights, booking agencies, and so on.

Things are looking brighter now. The concept of “revenge travel,” has taken the world by storm. In this article, we explore the current state of travel by taking a look at web traffic data from before, during, and after the pandemic.

Before the storm

Before Covid hit the scene with the force of a jet-propelled semi-truck, global travel culture had been on the rise. Millennials were taking an average of five trips per year. Freelancing’s significant growth allowed people to be more nomadic. Even Generation Alpha (people born after 2010) had begun influencing the travel scene in surprising ways. Households with children born after 2010 were taking an average of three family vacations a year.

The middle class was growing. PTO usage was ticking slowly but surely upward. And the concept of remote collaboration was picking up momentum at a pace that—though quaint compared to what would be seen just months later—freed people from being strictly desk-bound.

All totaled, travel-related spending was up 4% from 2018, leading market analysts to have a generally positive outlook on the state of the industry as a whole.

Of course, we all know what happened next. Covid-19 went global in the Spring of 2020, effectively shutting down travel everywhere.

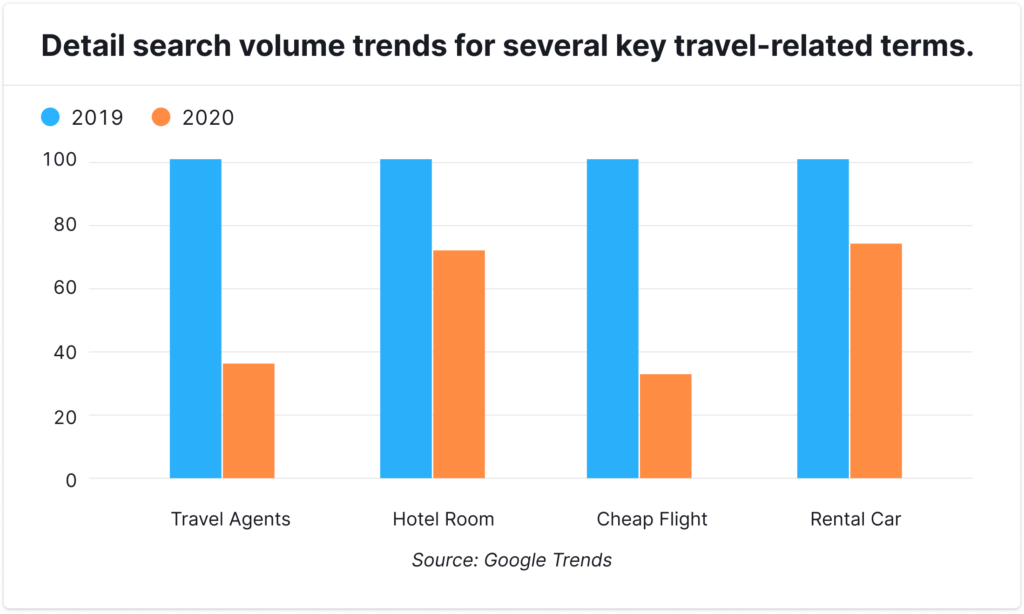

In the chart below, we detail search volume trends for several key travel-related terms. The dataset is from between the summers of 2018-2020 and comes from Google Trends. Note that Google Trends demarcates data based on scale. The number “100” indicates that all of the search terms shown below hit their maximum frequency in the summer of 2019. The 2020 numbers indicate search term volume relative to where they were at the peak period.

In other words, the search term “Travel Agent,” peaked in the late summer of 2019. By late summer 2020, that term’s search volume was at 34% of what it had been.

Startling though the drops are, they shouldn’t be terribly surprising. In the early months of the pandemic, billions of people worldwide were still restricted by stay-at-home orders.

The bottom fell out. Hotel occupancy fell to 25%. More than 4 million jobs in the hospitality industry were lost. Hotel revenue fell by half. Business travel tapered off by 85%. Car rentals fell so drastically that 30% of the overall rental fleet had to be sold to recuperate revenue—which subsequently led to massive rental car shortages that furthered the industry’s chaotic year.

Those that did need a rental were forced to rent UHauls. As Ed Bastian, CEO of Delta Airlines said, “This is not a three-month or six-month crisis. For Delta, it’s a multiyear process before we get back to normal.”

The worst of the Covid has been behind us for a while now. Travel has largely gone back to pre-pandemic norms. In the next section, we analyze what that looks like with the help of recent search volume data.

Our findings

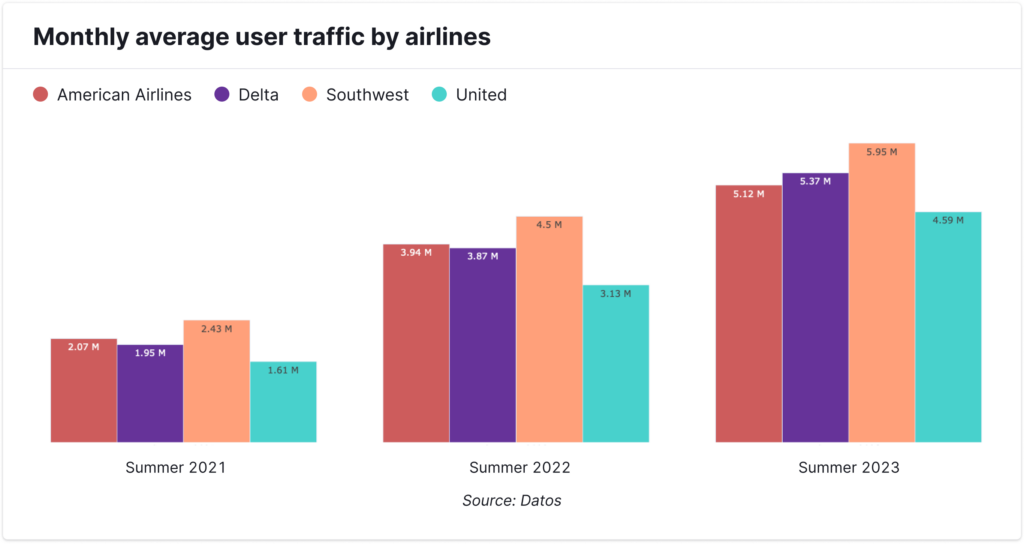

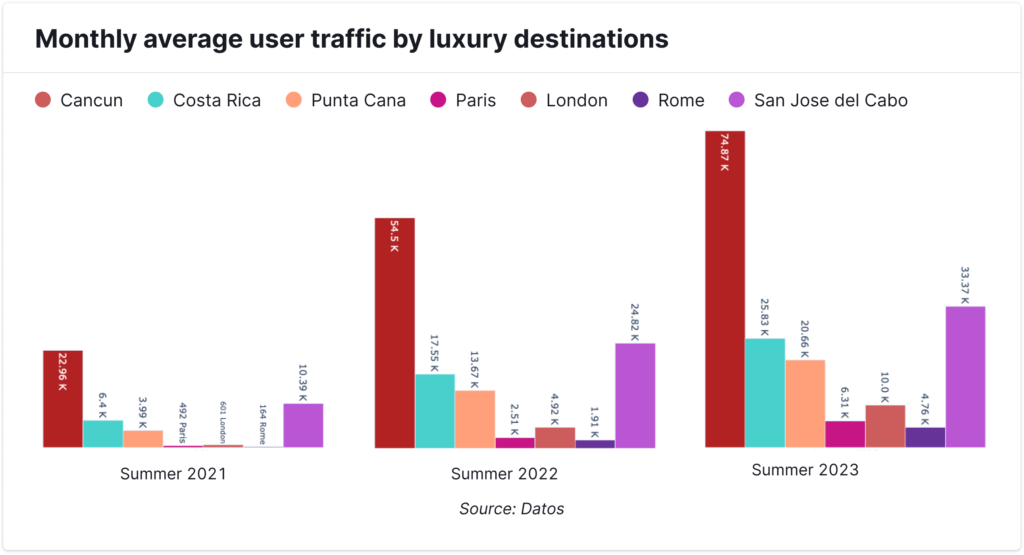

To get a read on where the travel industry is currently at, we took a look at US-based travel-related search volume data from Datos covering the last three summers.

The Summer of 2021 represented a tentative step toward pre-pandemic norms. On the one hand, vaccine accessibility was beginning to gain significant traction. On the other hand, travel restrictions were still in place, and the Delta variant was creating outbreak spikes.

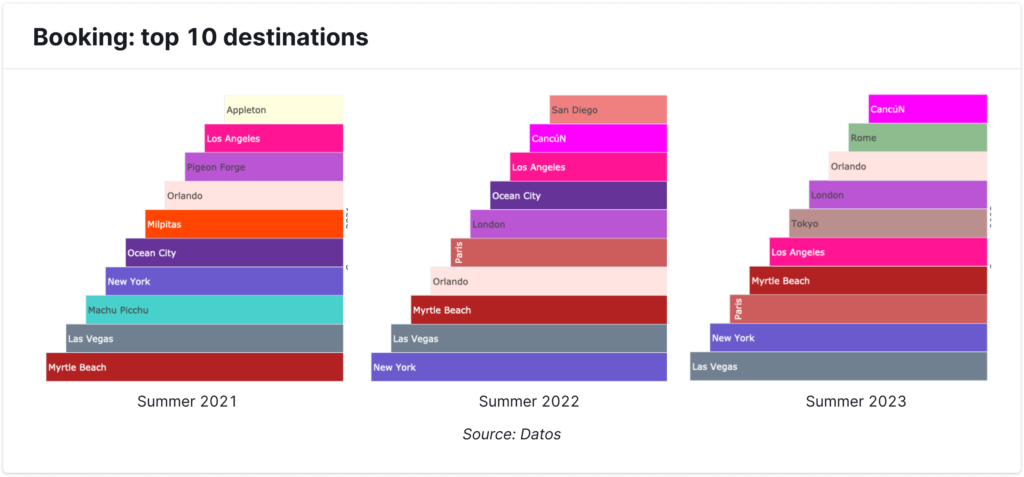

People that did travel largely opted for outdoor, domestic destinations. Our booking search volume data indicated a significant interest in Myrtle Beach. The summer of 2021 also saw a record number of people visiting National Parks.

While Las Vegas did generate the second-highest booking search volume in 2021, it is worth noting that the McCarran International Airport in Las Vegas is one of the busiest in the country, and that there are several prominent parks within driving distance.

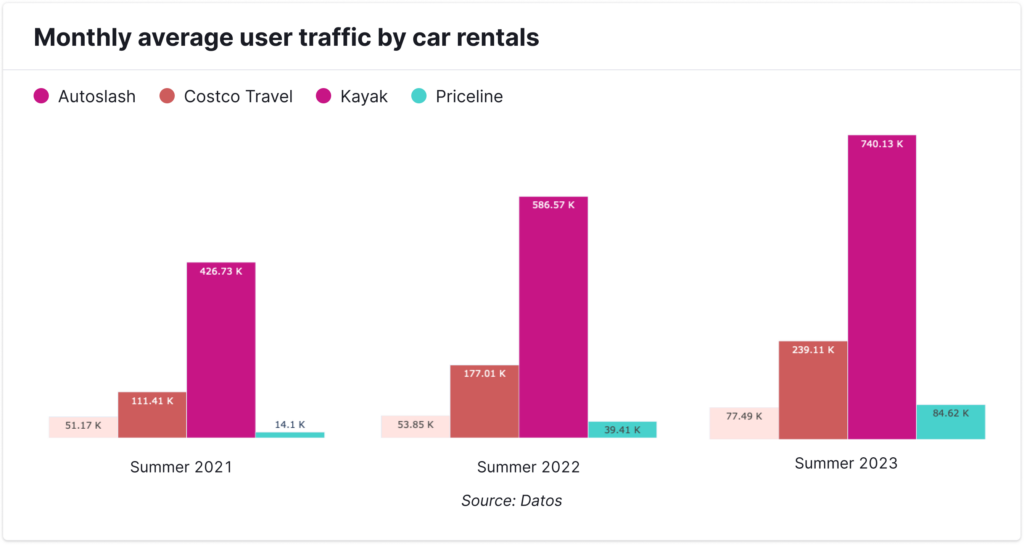

The summer of 2022 did represent a significant step toward pre-pandemic norms. Car rentals and air travel were up. Search volume for travel agencies almost doubled from 2021. And, after a summer of primarily domestic travel, people finalling began venturing out of the country. Paris featured as the 5th most popular booking destination from our 2021 data set.

In 2023, the focus continued to shift toward cities, both domestic and international. Vegas, New York, Paris, LA, Tokyo, and London. Travelers consistently focused on locations that were off-limits the last two years. These findings remained consistent across social class. Our luxury search volume analysis revealed that interest in travel to Paris, London, and Rome almost doubled in 2023.

In short, our findings support the conclusions that many travel industry analysts have been reporting. While 2022 did provide people with their first taste of post-pandemic freedom, 2023 travel was propelled by a convergence of several potent factors that pushed travel over the edge. In the next section, we will look at how freedom, access, and desire led to a record-setting summer.

The State of Travel

There are hundreds of stats all pointing in pretty much the same direction: After a three-year stretch with more ups and downs than Space Mountain, the state of travel finally looks strong. Not only are people on the move again, but they are going places that were off-limits just two years ago. Big cities. International destinations, and so on.

Even inflation and fears of a recession have not significantly influenced summer travel plans.

There are pockets where pre-pandemic norms still haven’t quite returned. Global international travel was down 27% compared to the summer of 2019—though this likely owes to the fact that flight prices are between 25-60% higher than they were pre-pandemic.

However, even that is changing. In July of 2023, 40 million Americans traveled abroad—a number that exceeded pre-pandemic levels.

It’s certainly fair to say that memories of Covid propelled many people to make up for lost time. A Deloitte survey revealed that 20% of summer travelers cited trips missed during Covid as a strong motivation for their vacation decisions this year.

At the same time, all this travel buzz is freezing some people out. The Deloitte survey cited earlier also reported that 50% of people who didn’t travel this summer abstained for financial reasons.

“The return of international travel, the return of business travel. That means rock bottom prices are not coming back anytime soon,” Clint Henderson, travel editor at “The Points Guy,” says.

It’s fair to mention that post-Covid excitement isn’t the only thing fueling travel. The U.S. dollar is relatively strong compared to European currency, and the last significant Covid traveling restrictions (masks, testing, isolation, etc.) were dropped in Asia last fall and winter. Fully vaccinated travelers can now access almost two hundred countries without any testing requirements.

The remote work boom is playing a big role as well. Nearly 30% of people are still working from home. Out of all the factors driving 2023’s travel boom, this will perhaps be the most enduring. Almost 70% of remote workers report that the flexibility of their work arrangement has encouraged them to take more trips.

The phrase “pre-pandemic norms” is used a lot to discuss travel trends. But while 2019 does provide valuable context in helping us understand the choices travelers are making now, its relevance shrinks by the day. All signs indicate that the travel industry has reached its post-pandemic phase. In other words, a new normal.