Chat GPT continues to dominate headlines, and its impact is reverberating throughout the industry. It is fueling interest in the AI category as a whole, and a range of emerging (not to mention competing) AI startups. To use a metaphor popularized by President John F. Kennedy, “a rising tide lifts all boats.”

To quantify these dynamics, we looked at traffic to nearly 100 sites from the top players in AI. Specifically, we looked at monthly traffic figures as well as traffic growth from December 2022 through February 2023. The data come from Datos – a global clickstream data provider focused on licensing anonymized, at scale, privacy compliant datasets. Their data offers insights into many aspects of digital behavior, including website traffic and search behavior.

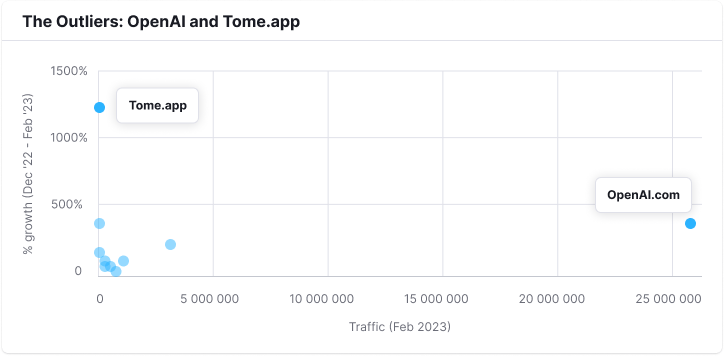

The Outliers: OpenAI and Tome.app

We start with an analysis of 20 of the most-visited sites (each with at least 10,000 visitors per month). They boast a median of 54% growth since December. An initial plot of these 20 sites on the key dimensions of traffic and traffic growth shows a clear outlier on each dimension. In magnitude of traffic, no site comes close to OpenAI, the company behind ChatGPT. OpenAI’s 26 million visits in February is more than ten times larger than the next site on our list – AI-fueled translation site DeepL.com.

Among major sites, OpenAI.com ranked second on our growth index, displaying impressive 400% growth on the large base of 5.2 million visits it got in December of 2022. But that growth pales in comparison to the 1200% growth of Tome.app, an “AI storytelling partner.” It ranks 6th in magnitude of monthly traffic with nearly 100,000 visits in February. Their large percentage growth is certainly built on a small base of just over 7,000 visits in December, but it has ridden the ChatGPT wave as effectively as anyone.

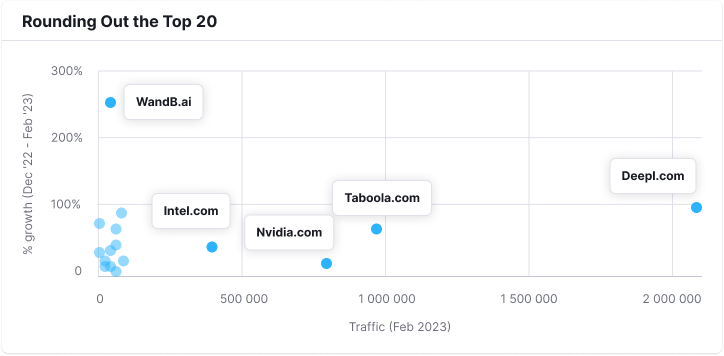

Rounding Out the Top 20

Digital markets are often “winner-take-all”, or nearly so. Search engine advertising is dominated by Google, social media advertising by Facebook, ecommerce by Amazon, etc. Often we have to remove these digital dominators to better see the dynamics among the “lesser players,” many of which are still mutli-billion dollar companies.

In this case, if we remove OpenAI.com and Tome.app from the chart, we begin to better see the differential rise in secondary players. DeepL.com’s strong traffic and growth figures become more apparent. And we begin to see a pattern that echoes another familiar metaphor– in a gold rush, it is not the miners who typically become rich, but those who support the new economy by selling shovels, mining tools, and blue jeans.

- Diversified chip-makers Intel and Nvidia power the back-end and profit from greater demand on computing resources.

- Taboola, an advertising company, profits off of readers’ interest in AI rather than AI itself.

- WandB.ai leads on our growth metrics among this group – making tools for machine learning, and boasting OpenAI and Nvidia among their customers.

That still leaves 14 players from our analysis of the top 20, tightly bunched on the metrics of this analysis. Many fit the “selling shovels” model and specialize in AI applications (such as content creation, meeting assistants, customer support) or cybersecurity.

Emerging Companies: Upstarts with Strong Growth on Small Starts

We started our analysis with 95 key AI sites, but so far have focused on the 20 most-visited sites, leaving the “bottom 75.” These are by definition less visited, and smaller sample sizes mean more variability in the data.

Still, in the aggregate, the data from these smaller sites largely reinforces our previous findings. The “bottom 75” show an average of 380% growth, and a median of 70%, comparable to the 54% median growth we observed among the top 20.

Growth Rates in Perspective: A Breeding Ground for Unicorns

Keep in mind the 50-70% growth we find “typical” of these AI sites is not an annualized growth rate, but rather over a mere three months, from December 2022 through February 2023. Past performance is never a guarantee of future growth, but annualized growth of 200%+ could be commonplace, and some will far surpass that. Clearly, the field is a fertile incubator for new unicorns. To mix metaphors: A rising tide of AI interest will lift all boats, especially for those selling “mining tools” that help build the ecosystem.